A Guide to Virtual Pag-IBIG: HDMF’s Online Services

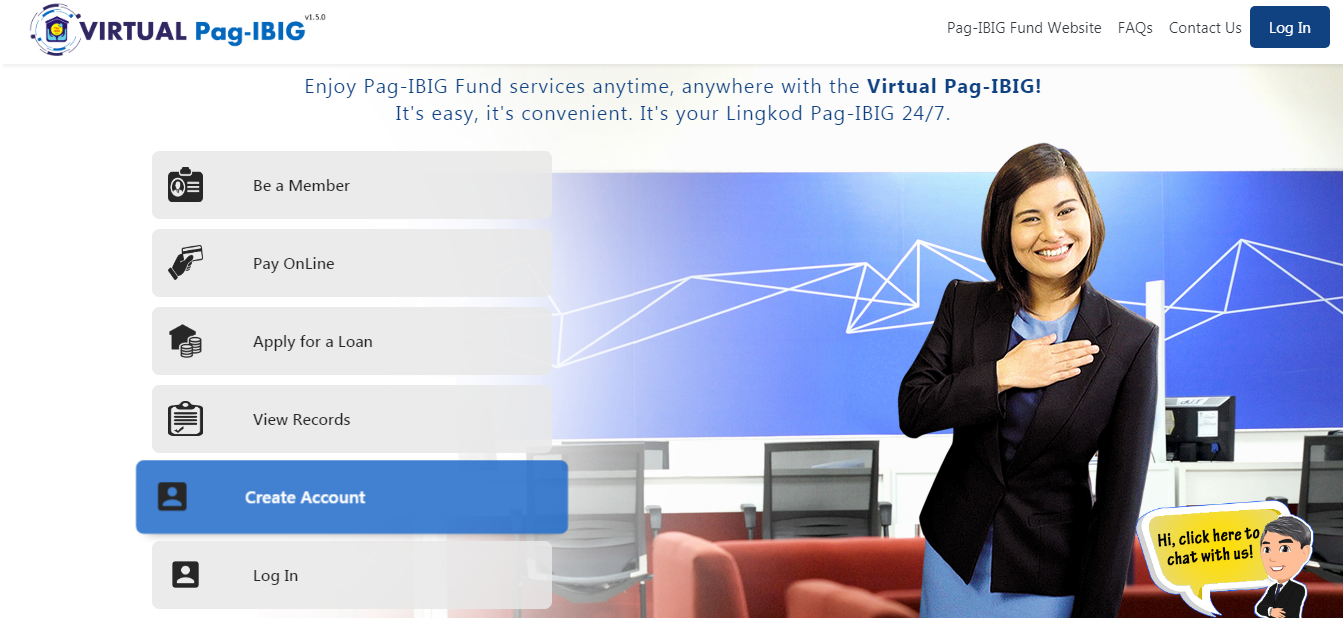

Virtual Pag-IBIG; is not online dating or finding love through the internet. It’s actually a program by the Home Development Mutual Fund of the Philippines. You can now check out your contributions in real-time, apply for a loan, or pay online. Here’s a guide to Virtual Pag-IBIG: HDMF’s Online Services.

SSS already has E-Services and can be accessed online; the Pag-IBIG Fund has one, too. This Virtual Pag-IBIG System can be accessed anytime as long as you have internet. You don’t need to line anymore or go to the nearest Pag-IBIG Fund Branch. There are a lot of services you can enjoy. So, learn how to register and use it below!

Other Articles You can Read:

How to Register in Virtual Pag-IBIG

STEP 1: Go to This website.

STEP 2: At the left-side corner, look for “Virtual Pag-IBIG and click it”

STEP 3: Click “create account.”

STEP 4: Choose the option: Create an Active account online.

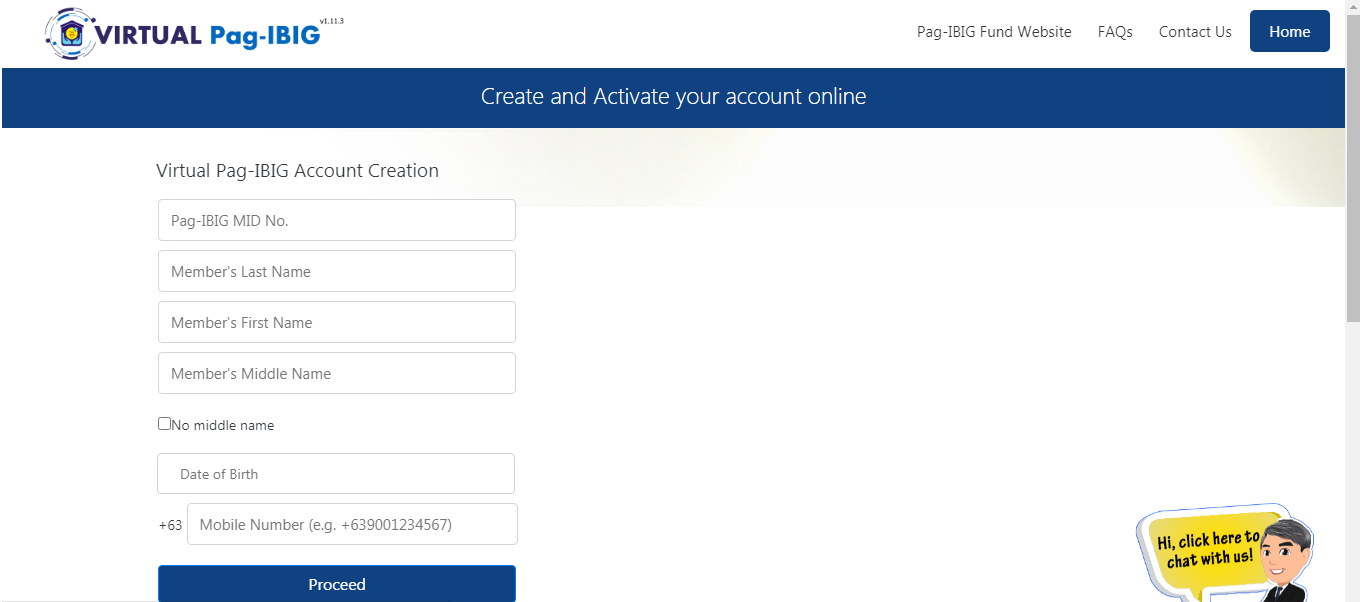

STEP 5: Enter the details asked. Make sure your number is active as an OTP will be sent there.

STEP 6: Enter the OTP sent by PAG-IBIG to your cellphone number.

STEP 7: Enter additional details asked.

STEP 8: Attach your selfie with your valid ID.

STEP 9: Submit it.

STEP 10: Wait for your PAG-IBIG Account to be activated.

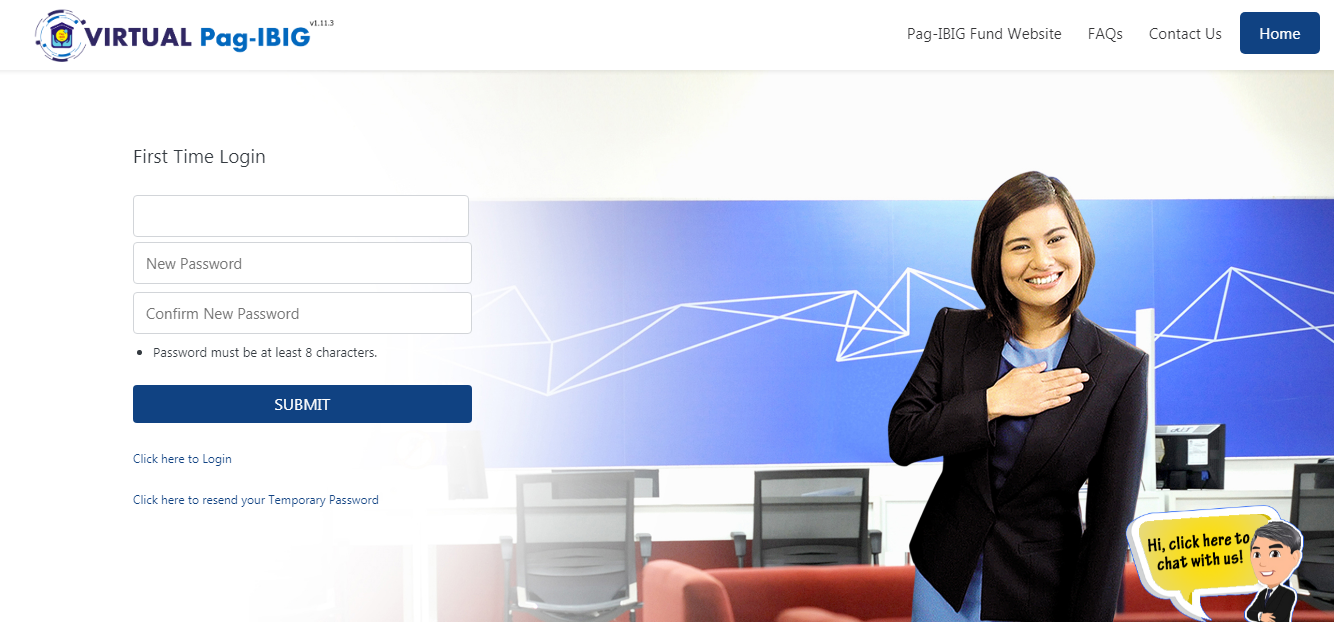

How to Log-in for the first time in Virtual Pag-IBIG

STEP 1: Open your e-mail account. There will be a temporary password shown in your e-mail.

As it’s your first-time logging-in, use the password given.

STEP 2: Click Verify.

STEP 3: Make a new password and submit.

STEP 4: It says your registration is successful, you can now log-in and enjoy the services of the account.

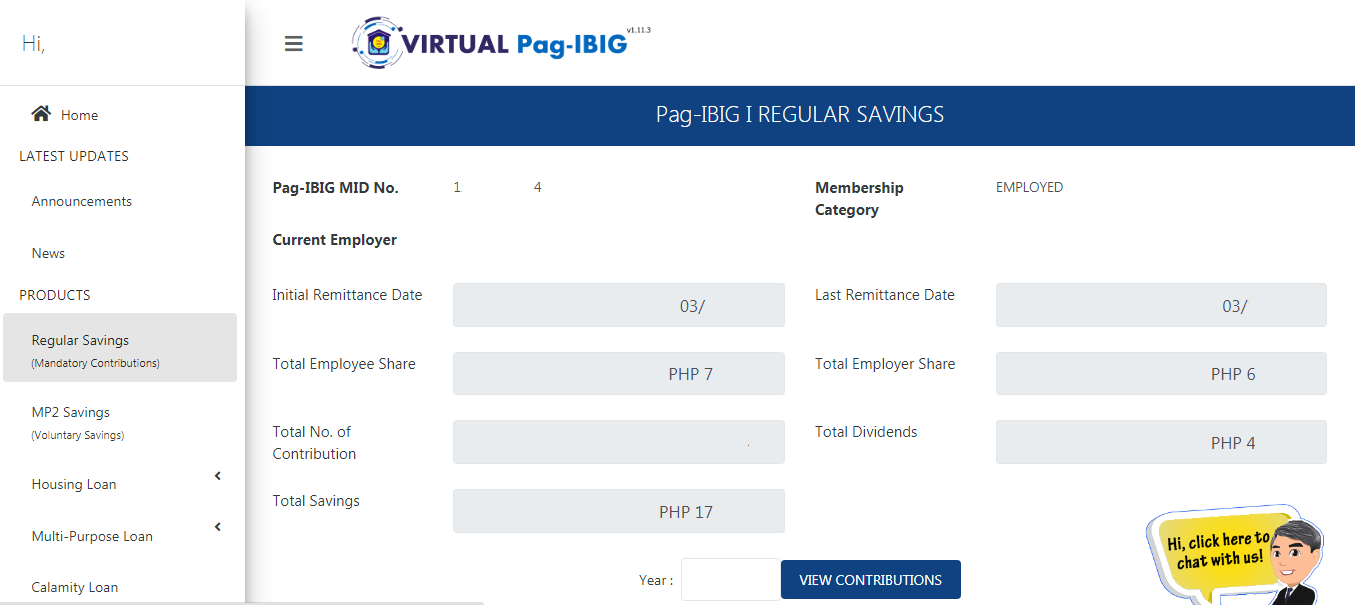

How to Check your Regular Savings

Regular Savings are your Mandatory Contributions plus additional savings.

It’s usually computed as

1% Employee’s Contribution Rate if Monthly Salary is below PHP 1,500 (Floor is PHP 1,000); or

2 % Employee’s Contribution Rate if Monthly Salary is above PHP 1,500 (Ceiling is PHP 5,000); and

2% Employer Contribution (Minimum of is PHP 1,000, Maximum of 5,000)

So let’s say you ear PHP 10,000 Monthly. Maximum is 5000 * 0.02 = 100. So you will contribute PHP 100 while another PHP 100 from your employer. It’s a total of PHP 200 in your account every month.

You can also add additional savings, which is more than PHP 100/200; we usually term this as MP1. You can upgrade your monthly savings, and it will reflect in your Regular Savings. The higher the savings, the higher your dividends, the higher the amount you can loan, too!

Check your regular savings here by clicking Regular Savings under Products.

You can also see your contributions under “View Contributions.”

You can see that employee savings is actually about 7K while the employer is 6k. There was a year where I increased my monthly contribution from PHP 100 to PHP 200. Hence, the difference. The dividends also increased every year since my savings increased. From a contribution of 17K, dividends are 4K already. Better than the bank!

As Per PAG-IBIG, you may withdraw your Pag-IBIG Regular Savings should any of the following occur:

After 20 years in Pag-IBIG = 240 monthly contributions

When you retire at age 60 (optional) or 65 (mandatory)

Separation from service due to health reasons

Permanent departure from the country

Permanent and total disability or insanity

Upon death, in which case, his legal heirs will receive his TAV plus an additional death benefit

Critical illness of the member or any of his immediate family member, as certified by a licensed physician

How to Check your MP2 Savings

MP2 Savings are Voluntary Savings. The contribution is at least PHP 500 a month for 5 years; however, you can stop if you want or make a one-time deposit.

See your contributions at MP2 Savings under Products. After that, you can choose the MP2 Account you have.

You can choose to receive your MP2 Dividends through any of the following options:

Upon full withdrawal of your MP2 Savings after its 5-year maturity period with your MP2 Dividends compounded annually;

Through annual pay-out with your MP2 Dividends credited to your savings or checking account enrolled in any of Pag-IBIG Fund accredited banks.

How to File a Loan using Virtual Pag-IBIG

Nowadays, you can get a Pag-IBIG loan at the comforts of your home. You don’t need to go to the nearest office to file it.

Click Multi-Purpose Loan. Then “Apply.” Just follow instructions until you are done.

However, there are some conditions, you will know if you can do it online. Unfortunately, I can’t do it here for the following reasons:

How to Pay Online in Virtual Pag-IBIG

You can also opt to pay online rather than go to the nearest branch or payment center.

STEP 1: Just go to “Pay Online” and choose what kind you will be paying.

They accept Philippine Issued Debit or Credit Cards or Paymaya E-Wallet.

STEP 2: Enter the details asked then click next.

STEP 3: Review the information and proceed to payment.

STEP 4: Pay the contribution plus service fee.

STEP 5: Receive a confirmation of your payment.

You can check if your contribution is updated on your accounts.

That’s our guide to Virtual Pag-IBIG: HDMF’s Online Services. You can check your contribution and pay online to this organization. At least you’ll know up to date if your deductions are indeed reflected and how much you can withdraw on maturity. I hope this helps!

About the Writer

Hey, I’m Lyza! I once was a person who just imagined going to places “one day” but decided to pursue my dreams. My first travel abroad was in Japan, solo, last 2018, and I fell in love with the experience. I aim to visit 10 countries before turning 30 and 2 new places in the Philippines every year. Besides traveling, I love organizing trips, taking pictures, reading, and making new friends. Follow my adventures through my Instagram.

Click this for the Directory of Visa Applications Guides & Tips For Filipinos

Are you on Pinterest? Pin these!

![How to Use Instagram to Promote Your Travel Blog & Earn Money [Digital Marketing Tips]](https://images.squarespace-cdn.com/content/v1/5806a87f6a4963c2ddce112c/1584528831807-78QSGIBZEOOQLPGIPPPF/image-asset.jpeg)