The Best Travel Insurance For Filipinos Traveling To The Schengen Area

Europe, especially the Schengen Area is one of the most sought-after destinations for Filipino Tourists. There’s no doubt about that as each country is culturally distinct despite being only a few hours away from each other by train. I know at least once in your life, you’ve dreamt about seeing The Eiffel Tower in Paris, the Sagrada de Familia in Barcelona, the green landscape of Austria, the Aurora Borealis in Norway, the Leaning Tower of Pisa in Italy, among many others. These are things we only hear from our friends or see on TV and don’t we all wish to see it for ourselves one day?

I bet you all do so here’s an article on how you can get one of the requirements to get your Schengen Visa-- the travel insurance!

WHAT IS THE SCHENGEN AREA?

Not all countries in Europe are part of the Schengen Area. There are currently 26 member states where you can use your Schengen Visa and these are: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Switzerland and Sweden.

HOW CAN I GET THE SCHENGEN VISA?

I have thoroughly discussed on this post on how you can get that Schengen Tourist Visa including the step-by-step guide, documentary requirements, as well as the frequently asked questions. It is noteworthy to say that one of the requirements is:

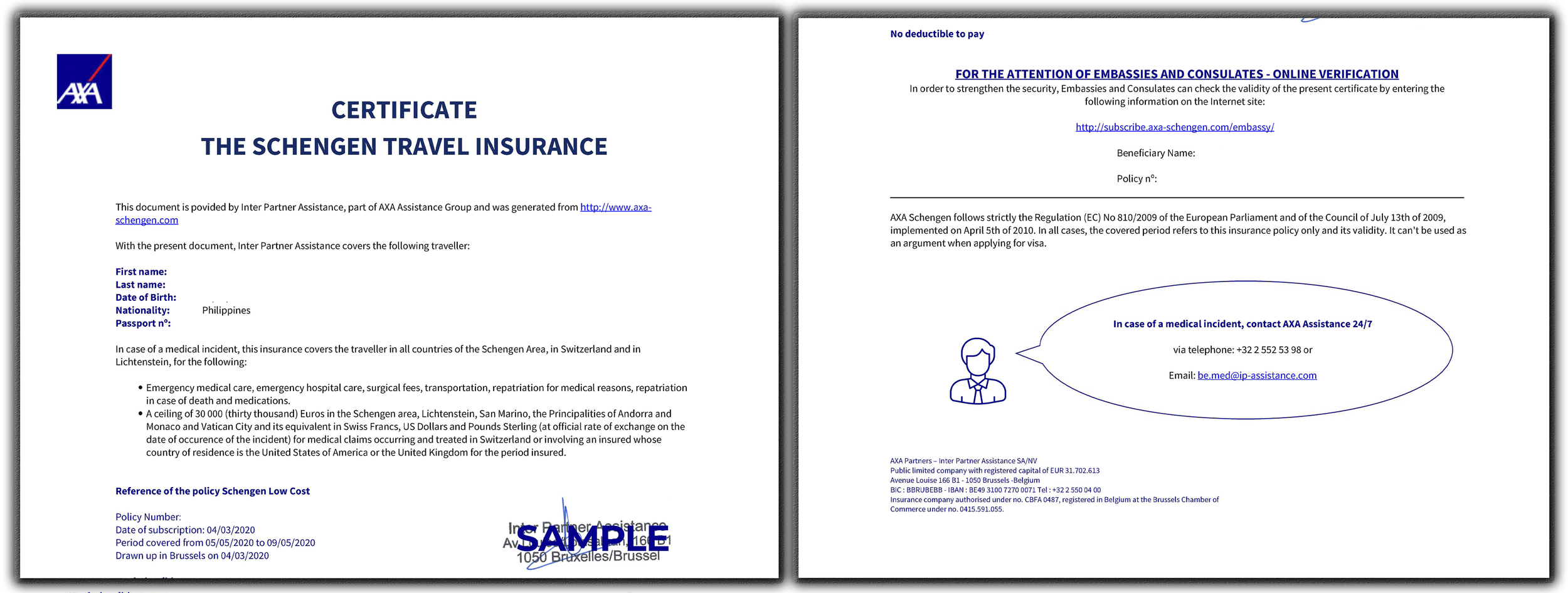

“A Travel Insurance that covers the entire duration of your intended stay with minimum coverage EUR 30,000”

Reading this at first glance will make you feel stressed thinking about where on earth can you get this and to answer that, you can get it from one of the best insurance providers in the country-- AXA Schengen.

WHY SHOULD I GET MY SCHENGEN VISA FROM AXA?

Aside from being one of the best, if not the best insurance provider in the country, here are some of the many things why you should choose them as your insurance partner in your European Tour:

1. They have a Low-Cost Travel Insurance

With AXA, you can be protected in your entire trip in the Schengen Area for as low as 0.99 Euros per day. That’s really cheap compared to other insurance providers.

2. They have extended coverage outside the Schengen Area

With this Low-Cost Travel Insurance, not only will you get coverage in all the Schengen Countries, but you’ll also get coverage in Liechtenstein, San Marino, Andorra, Monaco, and Vatican City.

3. They have all the benefits you’ll need

With this amount, you’ll get Emergency Medical Expenses for up to 30,000 Euros, Repatriation to the country of residence if necessary, Access to emergency medical care, and Assistance in case of death (which we all hope won’t happen).

4. They have a 24/7 Emergency Helpline

If something comes up whatever time of the day it is and wherever you may be, expect a knowledgeable medical staff to pick up, answer all of your queries, and assist you in finding the best healthcare which is closest to you.

5. It meets all the requirements from the European Regulation

Did you know that AXA is a French Company? Now you do and that’s probably one of the reasons why they are fully compliant with the European Regulation. I’m sure that if anything happens to you and you have the famous insurance from AXA, then things are gonna be easier!

6. It’s easy to avail!

With a few simple steps, you can get your Insurance Coverage within the comforts of your own home.

STEP 1: Choose your Insurance Package;

STEP 2: Fill in your travel dates to receive an estimated rate;

STEP 3: Fill in the required details of the beneficiary;

STEP 4: Confirm your order and pay via Visa, AMEX, Mastercard, or Paypal; and

STEP 5: Wait for your policy to be sent to your email.

It is that easy! There’s absolutely no need for you to stress out about this very simple requirement :p

WHAT IF MY SCHENGEN VISA IS DENIED?

Now, this is the best part. There is absolutely no risk to get the insurance from AXA Schengen because unlike other insurance providers, AXA Schengen will refund the full price of the policy subject to the presentation of a letter of refusal. It will be returned to the same account you used to pay it with.

FAQS ABOUT AXA INSURANCE FOR THE SCHENGEN AREA

1. What is covered under Medical Expenses?

This includes the Medical and surgical fees, medications prescribed by a local doctor or surgeon, the cost of urgent dental care, up to a maximum of €150 per insured party, the cost of hospitalization if the doctors of AXA ASSISTANCE consider that the insured party cannot be transported, the costs of transport ordered by a doctor for a local journey.

2. What do I have to do in case of a medical incident?

Call AXA Schengen call-center in case of a medical incident. Medical assistance professionals will help you 24 hours a day and 7 days a week get the best care you need and the closest to where you are.

3. What if the medical expenses are too much?

In that case, AXA Schengen will directly pay the health care provider.

4. What do I need to do to claim for reimbursement?

In case you paid for something that is covered by the policy, all you have to do is fill out this form, attach all the original receipts, and send it to them in the address provided. Make sure to have a copy of your receipts.

5. How is the reimbursement made?

Thru your bank account. It will be reimbursed in Euros subject to the current exchange rate.

6. Do I need to bring the insurance policy when I enter the Schengen Area?

I highly suggest you bring your copy at all times. This is a very important document and the Immigration Officers might also ask this from you.

7. What if the insured party needed to be moved to another hospital following a medical incident?

The person who will determine this is the Medical Team of AXA Assistance. If he/she indeed deems it necessary, then they will organize and pay for the repatriation or transportation of the insured party who is ill or injured, under medical supervision if necessary, and according to the seriousness of the case by the following means: Rail (1st class), Ambulance, Regular airline in economy class with special equipment if necessary, and Medically-equipped aircraft.

If the condition of the insured party does not require hospitalization, he/she will be transported to his/her country of residence.

It is very important to know all about your Insurance Policy so make sure you read all the terms in the Insurance Policy. Don’t worry because unlike many insurance companies, their policy is in font size 11 which makes it easy for you to read. Haha. I don’t think I need to say more because, through all these years, they have already created a name for the company. It is indeed the Number 1 Global Insurance Brand which Filipinos can certainly trust! :)